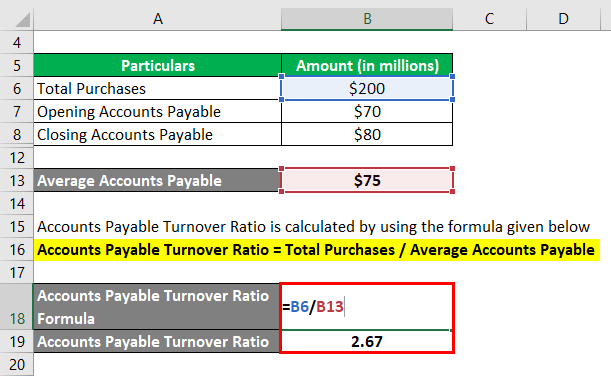

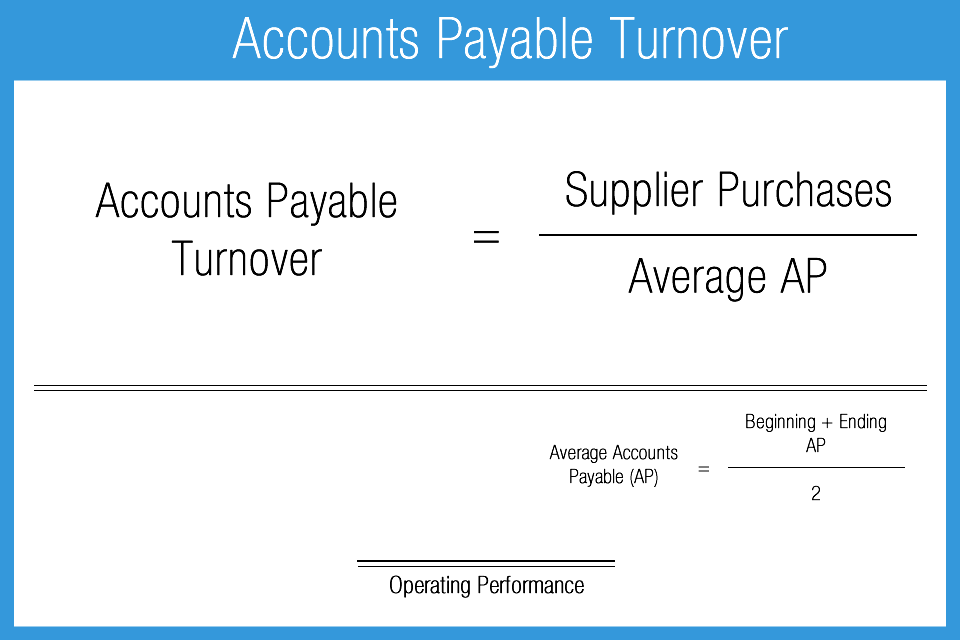

This is a model for beginners to learn how the A/P turnover ratio works. The amounts from average accounts payable and the number of times suppliers are paid a good measure of the short term liquidity of a business. Accounts payable turnover is sometimes referred to as the creditor’s velocity or creditor’s turnover ratio. It can also be used to evaluate how fast or slow a company is paying off its suppliers. Accounts payable turnover is simply the number of times a company pays its suppliers in one year. This accounts payable turnover Excel template lets you quickly calculate the accounts payable turnover ratio and measure the number of times a company pays its suppliers in one year.Īccounts payable turnover ratio is a financial ratio of the net credit purchases of a business to its average accounts payable for one year. If a competitor, ABC Company has APTR of 17, then the one with 17 is said to be paying its suppliers well as compared to the other one with APTR of 4.

The company was paying its suppliers 4 times annually.įrom the examples above, XYZ company has a APTR of 4. To compute accounts payable turnover in days you can use days payable outstanding. Also, we can accounts payable turnover ratio as an indicator of efficient delivery of supplier’s short term debts.Ī high accounts payable turnover shows that the company has a desirable policy in its dealings and is probably not taking advantage of its suppliers while a low payable turnover is an indicator of financial distress and it signals that the company has a cash flow problem such that it is not able to pay its bills.Īccounts payable turnover also varies across different companies and industries. Depending on the cash situation of the company, suppliers can either receive their pay faster or slow.Īccounts payable turnover, therefore, can be used to judge the company’s financial status as well as the creditworthiness of a company. These average accounts payable a company has in a typical period of one year. The amounts from average accounts payable and the number of times suppliers are paid a good measure of the short term liquidity of a business.Īccounts payable turnover is expressed in terms of times, and it shows how many times accounts payable are paid over a given period. Accounts payable turnover ratio (APTR) is a financial ratio of the net credit purchases of a business to its average accounts payable for one year.

0 kommentar(er)

0 kommentar(er)